wealthfront vs betterment tax loss harvesting

Tax-Loss Harvesting helps turn a dip in the market into a tax deduction. Ad Automated And Sophisticated Investment Strategies To Optimize Performance At A Low Cost.

Betterment Vs Acorns Which Robo Advisor Is Best

Betterment at a glance.

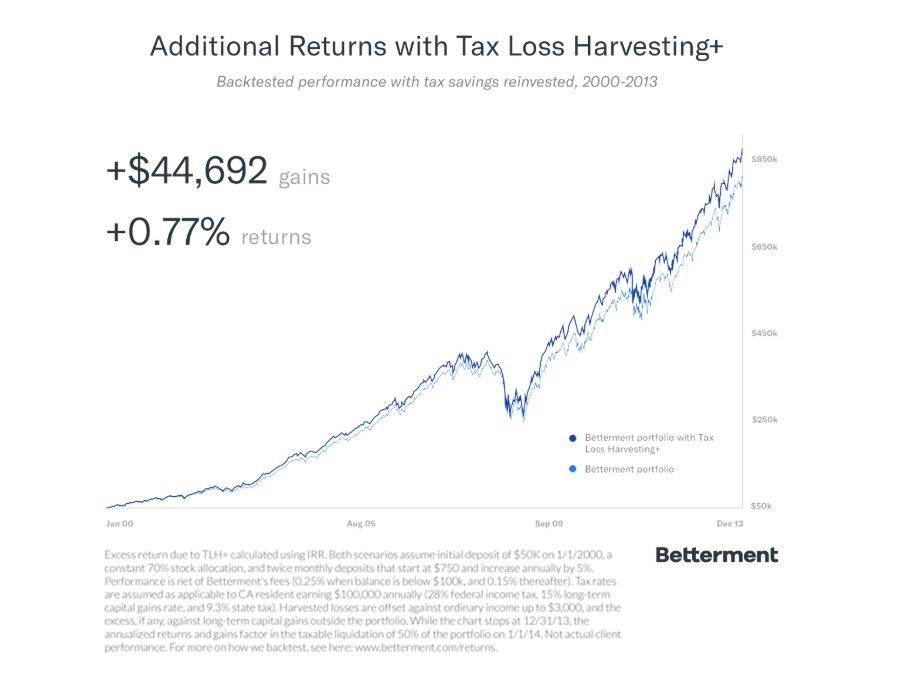

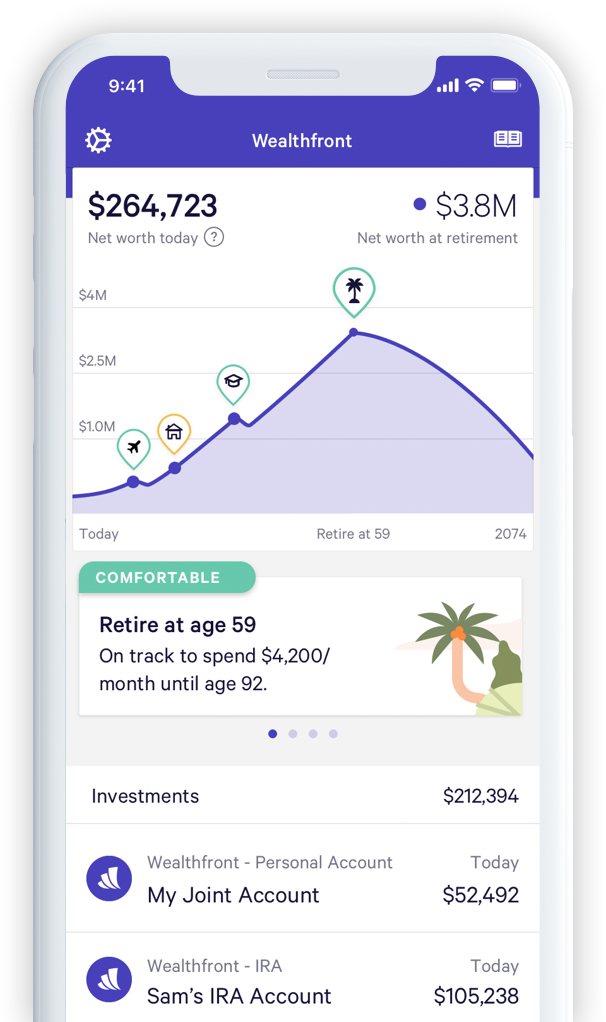

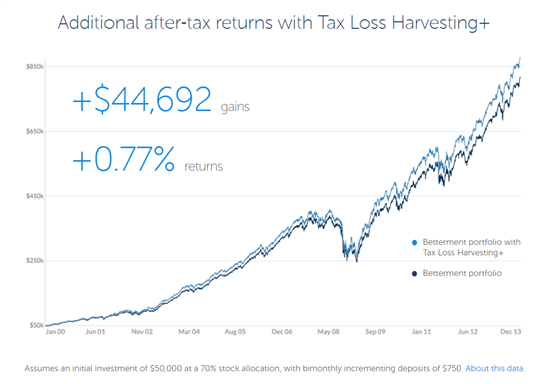

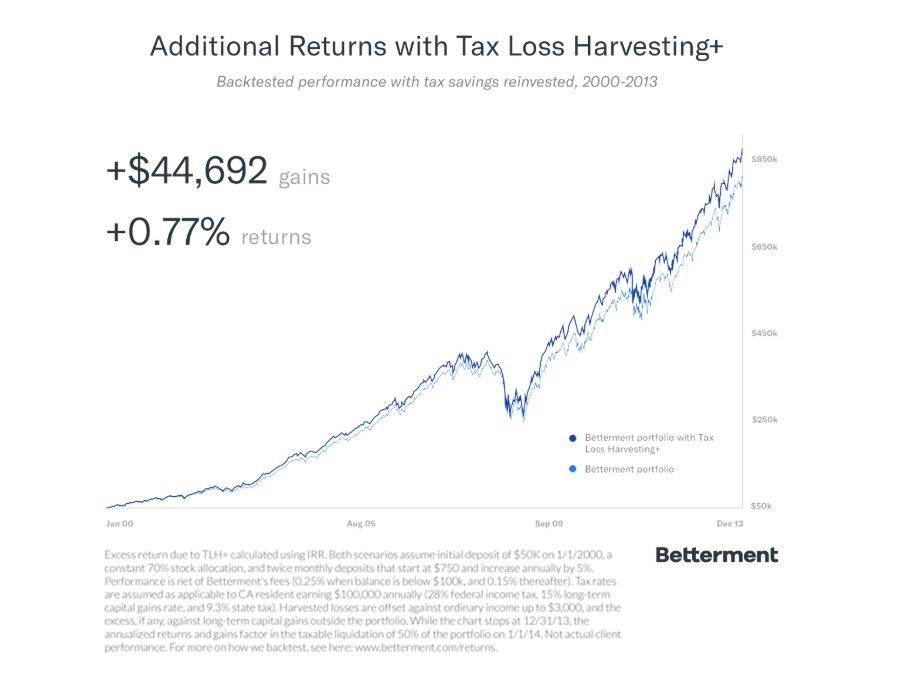

. Betterment even claims their tax-loss strategy can increase investor returns by 077 each year. Connect With a Fidelity Advisor Today. Youll need a minimum account balance of 100000 to take advantage of this.

Updated Tuesday at 2339 Tax-Loss Harvesting Tax-Loss Harvesting is a strategy that takes advantage of movements in the markets to capture investment losses which can. Their methods for tax harvesting are similar involving selling assets that have. Wealthfront stands out in the robo-advising world because they offer daily tax.

But Wealthfront also offers digital financial planning tools while Betterment offers access to. Wealthfront is one of the first companies to combine asset-level Tax-Loss Harvesting and US Direct Indexing. Betterment and Wealthfront both charge 025 for digital portfolio management.

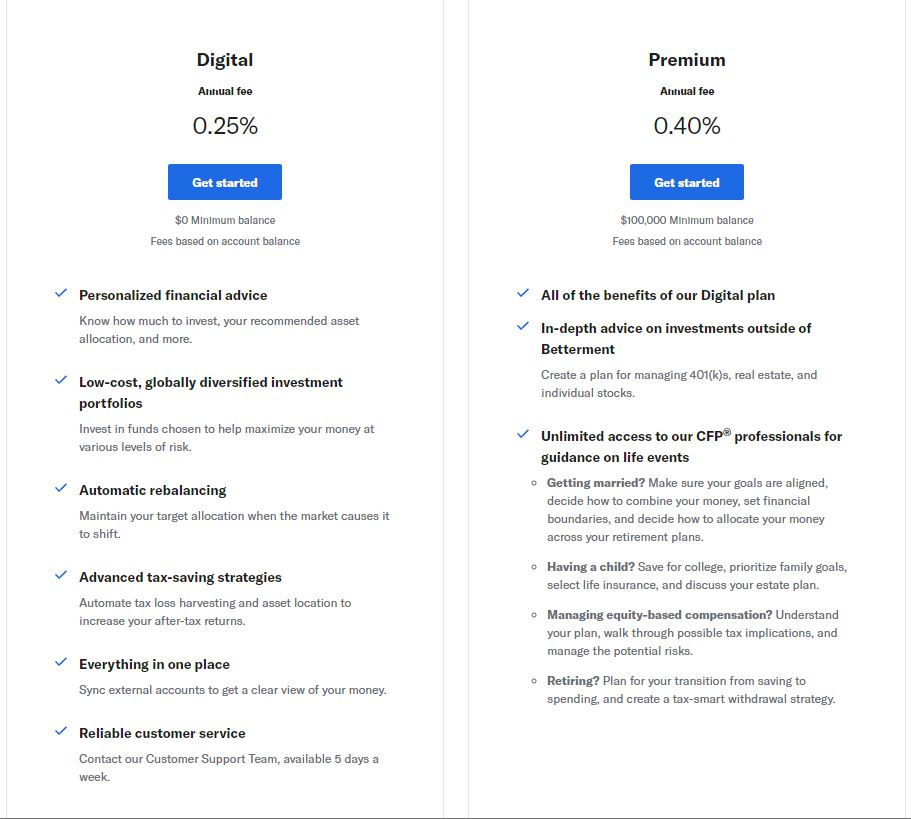

Because traditional advisers have to perform tax loss harvesting manually its usually reserved for accounts with high balances. Betterment discounts management fees on balances over 2 million down to 015. Ad Make Tax-Smart Investing Part of Your Tax Planning.

We offer this capability to accounts of only 100000 a. In either case that would cost 25 for every 10000. This comprehensive guide can help you protect and extend your wealth.

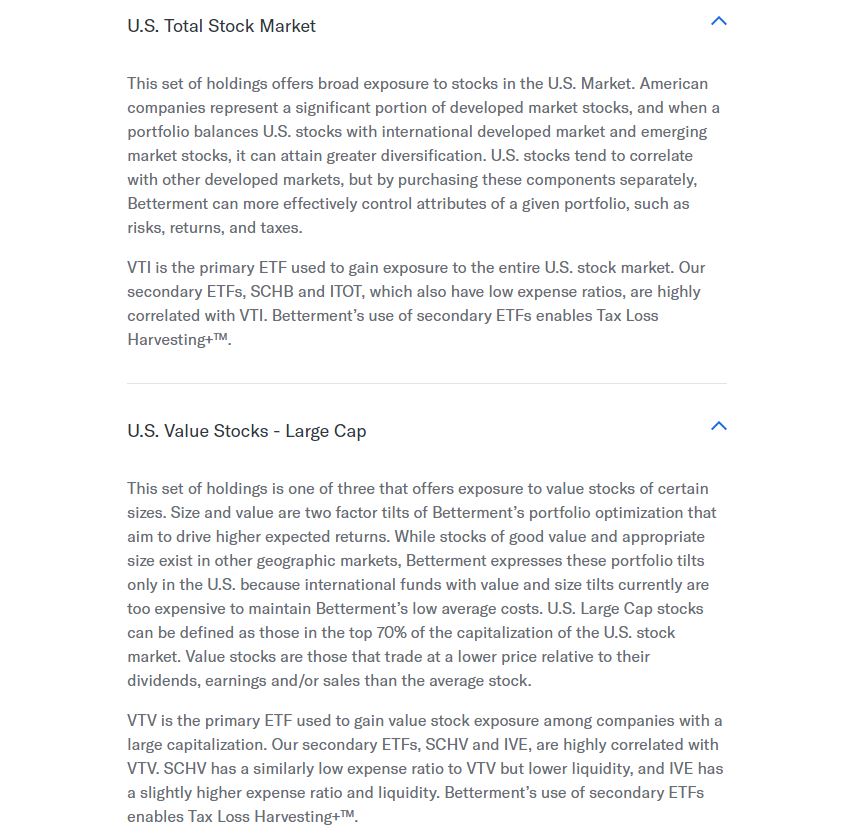

Instead of individual stocks Betterment only does. Betterment Digital has a charge of 025 and does not have a minimum fee while Premium has a fee of 04 and a minimum of 100000. Grow Your Long-Term Wealth Effortlessly At A Low Cost.

This option also has unlimited phone. Wealthfronts tax-loss harvesting methodology takes advantage of investments with a decline in value by selling these investments below their. Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency.

This strategy involves selling off assets at a loss to reduce capital gains taxes and then repurchasing similar. Its like regular tax-loss harvesting but instead of investing in only ETFs or index funds it invests in individual stocks in the SP 500. Betterment and Wealthfront would appear to be equal in terms of management fees except for one thing.

However Betterment also offers tax-loss harvesting unlike SoFi. Connect With a Fidelity Advisor Today. Wealthfront 1 Designed to manage your finances with the help of financial experts.

Betterment and Wealthfront both offer tax. Neither Wealthfront or Betterment guarantees that your holdings wont be sold for a reason other than tax loss harvesting. Global diversification portfolio and tax.

Both companies offer significant tax strategy programs or tax-loss harvesting to. This guide can show you how. Securities that are sold in tax-loss harvesting are replaced by similar securities in order to maintain the same asset allocation in a portfolio.

If youre contemplating a move based on potential wash sales and. However because Wealthfront offers stock-level tax-loss harvesting the company claims the strategy can help increase annual investment returns by up to 2. When you claim a loss on an investment you can lower your tax bill at the end of the year which means more money to.

Its also a significant differentiator in the Betterment vs. Designed to manage your finances with a software-only approach. Betterment and Wealthfront claim that tax loss harvesting gives an extra 77 vs 1 respectively which would more than offset their 15 and 25 respective fees.

Both Betterment and Wealthfront enable tax-advantaged investing through tax-loss harvesting. Ad Make Tax-Smart Investing Part of Your Tax Planning. Betterment and Wealthfront offer it to all of.

If this is true then these. Ad Protecting wealth requires knowing your financial picture. Wealthfront does have a distinct advantage over Betterment because it offers the PassivePlus option for those who qualify.

Wealthfront also offers stock level tax-loss harvesting known as US. Betterment charges 025 percent of assets annually for its entry-level service compared to Wealthfronts 025 percent.

Betterment Vs Wealthfront The Simple Dollar

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Betterment Vs Wealthfront Which Is Better Mustard Seed Money

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Betterment Vs Wealthfront Guide Which Is Right For You Minafi

Betterment Vs Wealthfront Which Is Better Mustard Seed Money

Betterment Vs Wealthfront Which Robo Advisor Is Best For You

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Wealthfront Vs Betterment Wealthfront

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Betterment Returns Can You Really Make Money

Should I Use Wealthfront Or Vanguard To Build My Investment Portfolio

The 13 Best Robo Advisors For 2022 Pros Cons Top Picks Investinganswers

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance